how long can you go without paying property taxes in missouri

In some counties this period lasts longer than others. A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent.

In Missouri the statute of limitations lasts a year.

. It varies from county to county but typically lasts for several months. Nevertheless if the home was not sold on the first three sales the homeowner does not have 90 days to redeem it. Wait too long and the recalcitrant property owner may find the.

If you dont pay your property taxes when theyre due your local taxing authority will start charging interest on your tax account. The property tax extensions vary for all people. The original owner of the property can repay the investor for the total amount of money spent at the auction plus 25 percent in penalties and re-acquire legal ownership.

This interest typically accrues monthly. In some cases taxing authorities will honor a January postmark but its best not to take the chance. It typically lasts one year in Missouri and is part of federal law.

Due dates for inheritance taxes vary by state. In Missouri you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your homeif the property sells. ECheck - You will need your routing number and checking or savings account number.

The length of this period differs by county so you should figure that out. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. Other real estate parcels are eligible for tax foreclosure sale after taxes remain unpaid for.

Taxes must be paid by that date so on February 1 all unpaid taxes are seen as delinquent. Some people may give an extension for around 30 days while others for 24 months. In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner.

In Montana if a property owner doesnt pay their taxes over a long enough period of time the deed can be transferred to a third-party tax sale purchaser often for pennies on the dollar. County-by-county this period typically lasts between 15 and 20 minutes. It depends on the county how long this is for each period.

For most jurisdictions property taxes are due by January 31. How Long Can You Go Without Paying Property Taxes In Missouri. One year of compliance is usually enough time for Missouri to apply for federal assistance.

A homeowner only has 90 days after the third sale to redeem his or her property on a property that has been sold three times. In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years. For example you could inherit property from an heir in one of the six states that do impose an inheritance tax like Kentucky.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. A year generally serves as a time period in Missouri. How Long Can You Go Without Paying Property Taxes In Missouri.

How Long Can You Go Without Paying Property Taxes In Missouri. What is a personal property tax waiver. If you dont pay your Mississippi property taxes state law allows the county treasurer to collect the delinquent amount by.

How long can you go without paying property taxes in Wisconsin. How Long Can You Go Without Paying Property Taxes In Missouri. How Long Can You Go Without Paying Property Taxes In Missouri.

If the auctioned property is a homestead--meaning it was the primary place of residence for the owner--the owner can buy back his tax deed within two years from the date of. In Wisconsin most people get a two-year redemption period to pay off all taxes penalties interest and other costs called redeeming the home before the county can start the process to get title to the property. There are differing lengths for this period based on the county in which they reside.

Typically Missourians live for one year during such periods. How Long Can You Go Without Paying Property Taxes In Missouri. Missouri Property Tax Rates The states average effective property tax rate is 093 somewhat lower than the national average of 107.

How long can you go without paying property taxes in Oregon. Vacant lots with petitioned specials are eligible for tax foreclosure sale after real estate taxes remain unpaid for 2 ½ years. Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year.

Interest and Penalties Will Accrue. When are taxes delinquent. Why Can You Go This Long Without Paying Property Taxes.

You may also incur monetary penalties. Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges. Property taxes can be paid in full by November 15 or in three installments.

Federal estate tax An estate could subject to the federal estate tax if its more than 1158 million. November 15 February 15 and May 15. Rates in Missouri vary significantly depending on where you live though.

Under Mississippi law you get a two-year redemption period after a tax sale. This means that the total balance you owe to your local government will begin to steadily increase. Despite this the homeowner only has 60 days after the second and third auctions to redeem the house.

Some states may allow the person to get an extension for around 3 years. A tax waiver also known as Statement of Non-Assessment indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

How long can you go without paying your property taxes in Mississippi. Another example of when you may want to pay someone elses taxes is if you inherited a property and the property is going through probate which can be a long process in some states. How long can property taxes go unpaid in Kansas.

As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. Owners who hold on to their homes for more than 90 days may only redeem them if they have been sold three times. In contrast if the home was only sold on the third sale the homeowner is only required to take 90 days.

In Oregon real proper- ty is subject to foreclosure three years after the taxes become delinquent. Then youd need to pay that inheritance tax. 140150 140190.

How To Use The Property Tax Portal Clay County Missouri Tax

Personal Property Tax Jackson County Mo

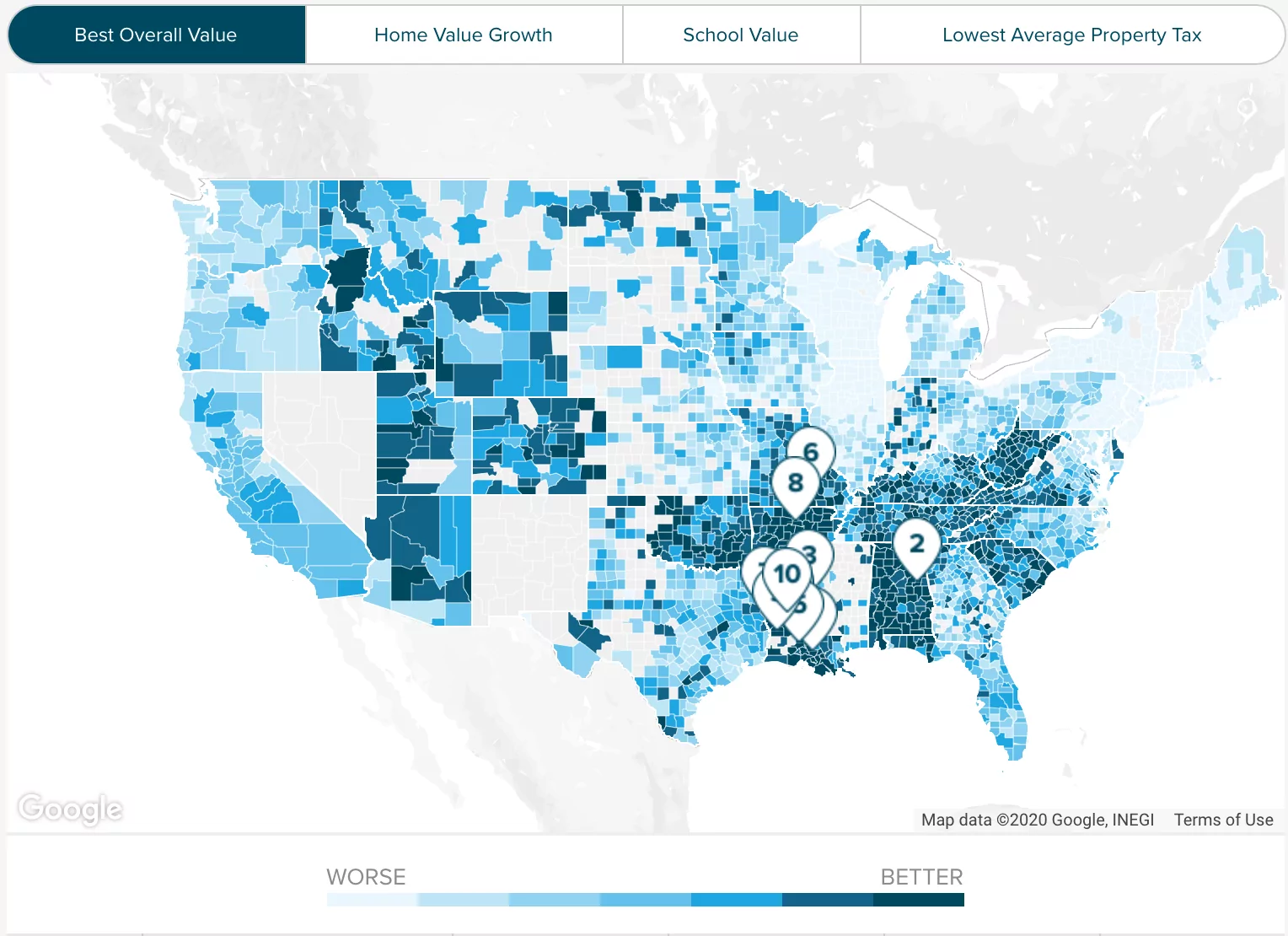

A Breakdown Of 2022 Property Tax By State

Property Tax Comparison By State For Cross State Businesses

Thinking About Moving These States Have The Lowest Property Taxes

Real Property Tax Howard County

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Disabled Veterans Property Tax Exemptions By State

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Alameda County Ca Property Tax Calculator Smartasset

Colorado S Low Property Taxes Colorado Fiscal Institute

Things That Make Your Property Taxes Go Up

Property Taxes How Much Are They In Different States Across The Us

What Is A Homestead Exemption And How Does It Work Lendingtree

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)