are funeral expenses tax deductible in australia

The only time that the IRS will allow a persons funeral expenses to become tax deductible is when the deceaseds estate pays for these costs. You can upload these records or share them with a tax agent at tax time to make lodging your tax return easier.

A New Tool To Help You Track Rent Payments Rent Payment Helpful

As well as claims against the estates certain taxes and certain debts incurred since July 1 2005.

. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs. Donations made to a personal GoFundMe fundraiser rather than a charity fundraiser are generally considered to be personal gifts and are not guaranteed to be tax-deductible. Can I deduct funeral expenses probate fees or fees to administer the estate.

In other words funeral expenses are tax deductible if they are covered by an estate. If the estate provides the cost of burial or funeral expenses you may be able to deduct themAn estate executor or someone else who would like to minimize estate estate income when it comes to the estate settlement. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductibleFor most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. If the person has money set aside expressly for covering his or her final expenses the estate can deduct these costs from its tax returns.

Deducting funeral expenses as part of an estate. The IRS deducts qualified medical expenses. Are Funeral Costs Tax Deductible In Australia.

There are no inheritance or estate taxes in Australia. Use this step-by-step checklist to manage tax for a deceased estate. In short these expenses are not eligible to be claimed on a 1040 tax form.

Qualified medical expenses include. Funeral expenses are not tax deductible because they are not qualified medical expenses. You can claim out of pocket costs linked to the harm you suffered like consultations with doctors and medical aids.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. Most are costs you incur to earn your employment income. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

To transport a body for a funeral or to transport the persons accompanying it represents an expense as does doing so. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Find out what out of pocket expenses you can claim in the COVID-19 vaccine claims scheme policy on the Department of Health website.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate. What to do when someone dies.

An itemized funeral expense list will allow you to deduct money spent on funeral expenses such as embalming cremation casket storage hearses limousines and florals. No never can funeral expenses be claimed on taxes as a deduction. Funeral expenses are not tax-deductible.

The estate itself must also be large enough to accrue tax liability in order to claim the deduction. What Funeral Expenses Are Tax Deductible. You may also claim the cost for getting the COVID-19 vaccine claims scheme medical report you need to.

You will not be issued a tax receipt from our company. As a Qualifying Expenditure. 2022 Guide to Tax Deductions in Australia.

If theyre paid for by friends family or even the departed individuals account they will not be deductible no individual deductions are possible here. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. What Funeral Expenses Are Tax Deductible.

Only donations made to GoFundMe charity fundraisers. They are never deductible if they are paid by an individual taxpayer. In this austrlia tax guide we examine the different tax deductions and expenses which should be accounted for when completing a tax return to ensure you pay the right amount of tax and claim back YOUR money for.

Deductible medical expenses may include but are not limited to the following. These are personal expenses and cannot be deducted. You can transport the deceased along with the person associated with him or her and so on for a funeral.

Placement of the cremains in a cremation urn. It is legal to deduct from the gross estate funeral expenses administration fees and any debts incurred by the estates administration Code Sec. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Basic Service Fee of the funeral director. Many estates do not actually use this deduction since most estates are less than the amount that is taxable.

According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. When completing your tax return youre able to claim deductions for some expenses. Work-related expenses such as vehicle trips general expenses such as gifts and donations.

Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. This includes a crematorium urn burial hearsse limousines and flowers.

When someone dies the person responsible for dealing with the deceased persons estate will have tax and super issues to manage. These expenses may include. Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate.

Funeral Expenses The costs of a funeral are deductible when covered by insurance. There is no limit as to what funeral expenses can be claimed as qualified expenses such as coffins hearsses limousines flowers cremation costs etc. But you can always check with a tax professional to be sure.

Conditions for Cremation Tax Deductibility.

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest

Do You Have To Report 401k On Tax Return It Depends

Taxation Part Iii Not For Profit Law

Are Funeral Costs Tax Deductible In Australia Ictsd Org

What Are Non Deductible Expenses Rydoo

Is Workers Comp Taxable Workers Comp Taxes

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

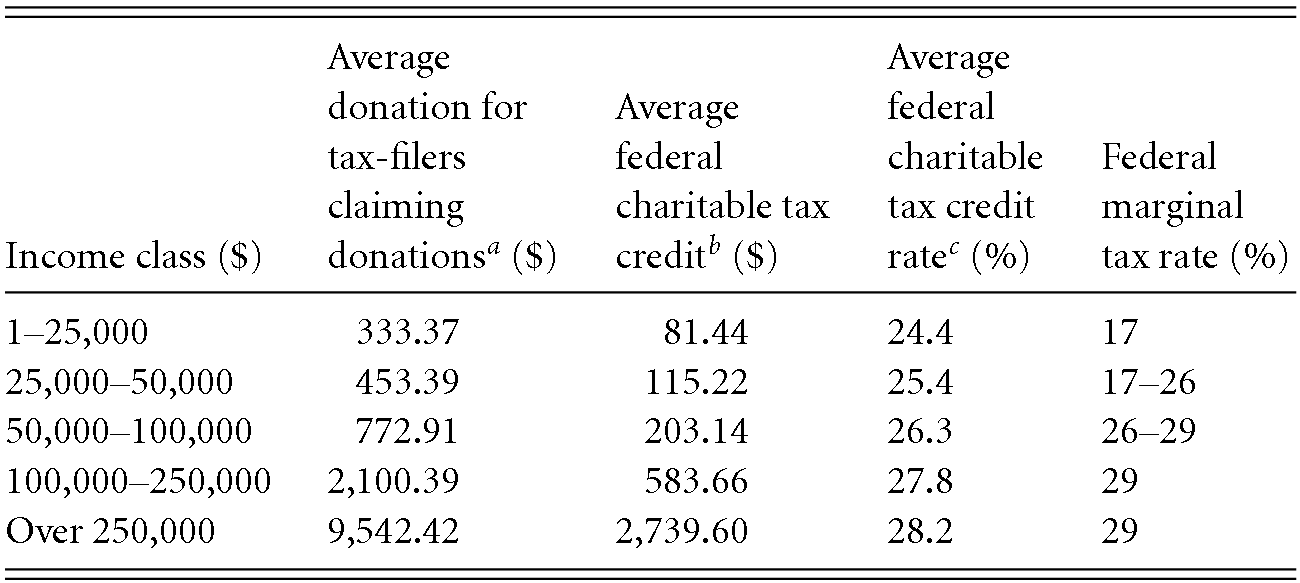

How Much Should You Donate To Charity District Capital

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest

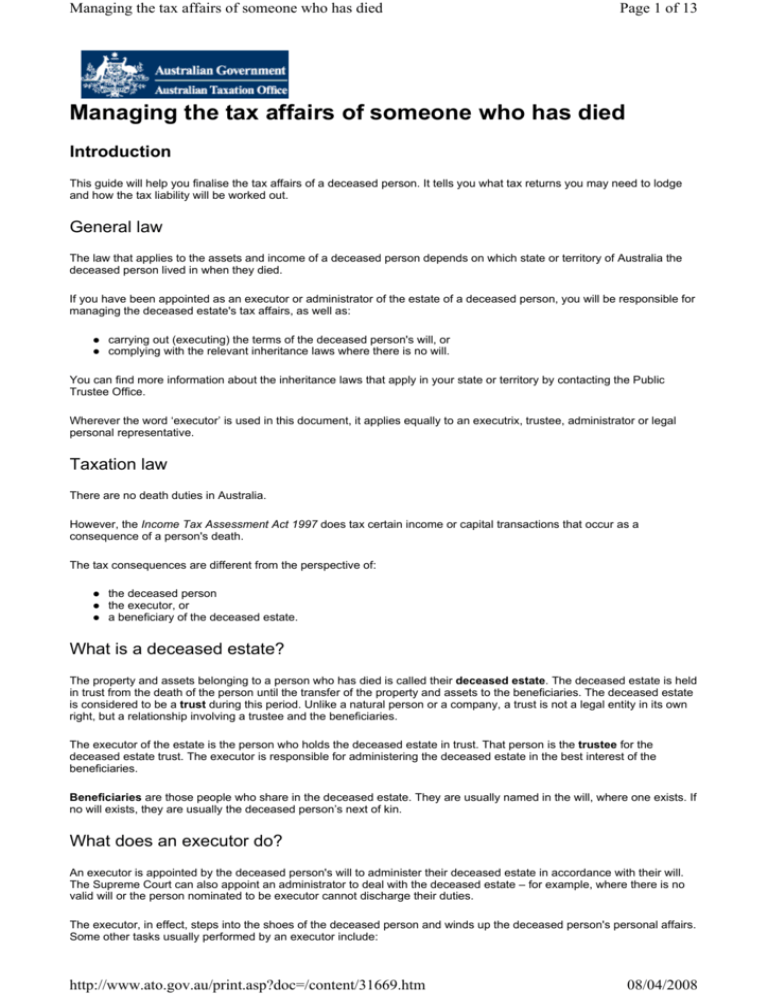

Managing The Tax Affairs Of Someone Who Has Died Ato Fact Sheet

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Lawn Business Tax Write Offs Lawn Love

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest

Know The Difference Between Decorating Uniforms For Travel Teams Vs Recreation Leagues Heat Printing Education Www Transferexpress Com Pinterest